If you’re contemplating real estate investment in the vibrant state of Arizona, you may be curious about the potential benefits of a 1031 exchange. This tax-deferred strategy holds significant potential for real estate investors, enabling you to postpone taxes on the sale of one property while reinvesting the proceeds in another. In this comprehensive guide, we will delve into the diverse spectrum of investment opportunities in Arizona and demystify the workings of a 1031 exchange within the state.

Diverse Investment Opportunities in Arizona

Arizona’s dynamic real estate market presents a myriad of investment options. Here are some prevalent property types for your consideration:

Residential Rental Properties:

Residential rental properties, including single-family homes, condos, and townhomes, are favored by investors in Arizona. With a growing population and robust demand for rental housing, these properties offer consistent cash flow and long-term appreciation potential.

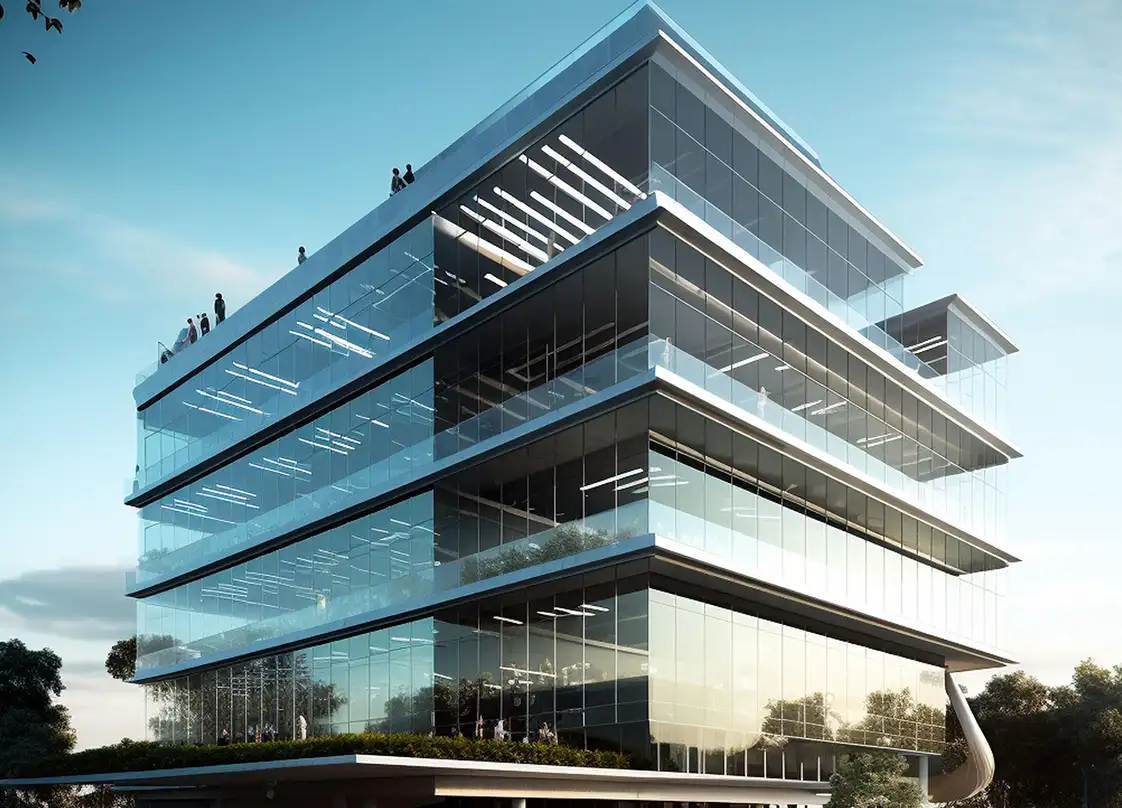

Commercial Properties:

The state boasts a thriving business landscape, making investments in commercial properties like office buildings, retail spaces, or industrial properties promising. However, note that these endeavours typically necessitate a higher initial investment compared to residential options.

Vacation Rentals:

Arizona’s status as a tourist hotspot makes vacation rental properties an attractive investment choice. If you intend to venture into short-term rentals, ensure you thoroughly research local regulations and tax implications.

Land Investments:

Investing in undeveloped land in Arizona can be a savvy move for those seeking long-term appreciation. Nevertheless, conducting due diligence on zoning regulations, utility access, and other factors affecting land value is crucial.

Multifamily Properties:

Multifamily properties, such as apartment buildings or duplexes, offer consistent cash flow and potential for appreciation. However, managing tenants and property upkeep can be more intricate compared to single-family rental properties.

Navigating 1031 Exchanges in Arizona

With a better grasp of Arizona’s investment property landscape, let’s delve into the specifics of executing a 1031 exchange in the Grand Canyon State. While the fundamental process of a 1031 exchange remains consistent across the nation, Arizona introduces certain nuances to consider.

Like-Kind Properties:

To qualify for a 1031 exchange in Arizona, your replacement property must be deemed “like-kind” to your relinquished property. The definition of “like-kind” isn’t as rigid as you might think, so it’s advisable to consult a Qualified Intermediary (QI) to confirm if your property qualifies.

State Taxes:

Arizona may impose a state-level capital gains tax, necessitating consultation with your tax advisor before selling your relinquished property. Additionally, property taxes and transaction taxes should be factored into your calculations for a comprehensive understanding of your capital gains liability.

Timelines:

Timelines for a 1031 exchange in Arizona mirror those in other states. You have a 45-day window from the sale of your relinquished property to identify potential replacement properties, with 180 days to complete the exchange.

Qualified Intermediary:

Collaboration with a qualified intermediary is paramount for a successful 1031 exchange in Arizona. They will oversee the exchange process, hold the proceeds from the sale of your relinquished property, and guide you through the identification and acquisition of replacement properties.

In Conclusion

Investing in Arizona’s real estate market can be a rewarding endeavour, and a 1031 exchange serves as a valuable instrument for deferring taxes and reinvesting your gains. Whether your interests lie in residential rentals, commercial properties, or undeveloped land, Arizona offers a spectrum of investment prospects. Remember to partner with a qualified intermediary and diligently consider the intricacies of 1031 exchanges to maximize your investment potential.